ㅁ Montana

Eligibility for Examination

As a first-time applicant, you must have:

- Completed at least 24 semester hours of accounting courses above the introductory level, including at least one course in each of the following subject areas:

- financial accounting,

- auditing,

- taxation,

- management accounting, AND

- Completed at least 24 semester hours in business related courses, such as:

- information systems,

- business law,

- finance,

- economics,

- marketing,

- ethics,

- organizational behavior,

- quantitative applications in business,

- communication skills.

All educational requirements must be met at the time of application. Official educational transcript(s) and/or foreign evaluations are required to be submitted to CPAES directly from the academic institution(s) or the evaluation service.

An upper-division course is normally defined as a course taken at the junior or senior level and would exclude introductory courses in accounting. One quarter unit or hour of credit is equivalent to two-thirds of a semester unit or hour.

Training completed as part of a Chartered Accountant program may be acceptable towards the education requirements for examination or licensure. Candidates must have completed the academic pathway through the Chartered Accountant program and submit an international education evaluation of the coursework completed.

Fees

First-Time Application

All first-time applicants are required to pay both an application fee and an examination fee upon submission of the first-time application (Once you have been found eligible, your candidate status will change to Re-examination Applicant.)

Application Fee – $245.00

Re-Exam Application

All re-examination applicants are required to pay both a registration fee and an examination fee at the time of re-exam registration.

Registration Fee – $100.00

Examination Fees

When applying you may select one or more sections of the examination at a time; however, you are advised to only apply for a section of the examination if you are ready to take it within the next six months.

Auditing and Attestation (AUD) – $238.15

Business Environment and Concepts (BEC) – $238.15

Financial Accounting and Reporting (FAR) – $238.15

Regulation (REG) – $238.15

ㅁ Vermont

Eligibility for Examination

As a first-time or re-examination applicant, you must:

- be of good moral character; and

-

- have earned a minimum of 120 semester hours of general college level education with 30 semester hours in accounting and business including:

- 6 semester (9 quarter) hours of financial and/or managerial accounting (excluding Introductory Accounting)

- 3 semester (4.5 quarter) hours of auditing,

- 3 semester (4.5 quarter) hours of U.S. taxation,

- 3 semester (4.5 quarter) hours of U.S. business law,

All educational transcripts, Certificate of Enrollments, and/or foreign evaluations are required to be submitted to CPA Examination Services. You may submit official school transcripts, Certificate of Enrollments and/or foreign evaluations separately or included with first-time application.

Beginning July 1, 2014:

All candidates will be required to have 150 semester hours to be licensed. Additionally, candidates will need to have a fully completed application on file with the Board, including successful completion of the examination, experience and education requirements prior to July 1, 2014, if they wish to gain licensure without 150 semester hours.

ㅁ 시험은 한국에서 응시가능

International Administration of the Uniform CPA Examination

In conjunction with the AICPA and Prometric, NASBA provides the opportunity for international administration of the Uniform CPA Examination (Exam) to be offered in India, Nepal, England, Scotland, Ireland, Germany, Japan, South Korea, Brazil, Bahrain, Egypt, Jordan, Kuwait, Lebanon, the United Arab Emirates, Saudi Arabia, and Israel.

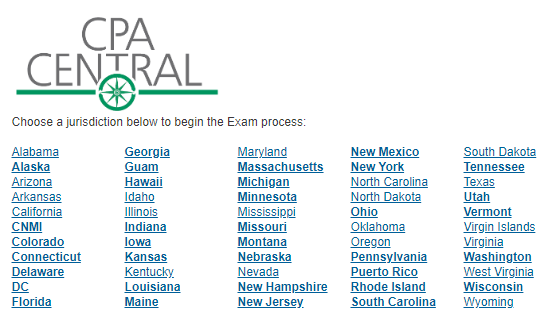

The Exam application process is basically the same for U.S. and international candidates. In order to qualify to take the Exam outside the U.S., you will have to establish your eligibility through a jurisdiction participating in the international administration of the Exam. Jurisdictions who do not currently participate in the international administration of the Exam are listed below.

To test in an international location, you must first select a participating U.S. jurisdiction, contact the Board of Accountancy (or its designee) in that jurisdiction to obtain application materials, and submit a completed application and required fees as instructed. After receiving the Notice to Schedule (NTS), you may then use the NTS to apply to take the Exam in an international location.

Qualified Uniform CPA Examination candidates in participating jurisdictions will have the option of testing at any international location where the CPA Exam is currently offered. Please see the below countries offering the CPA Exam:

- Bahrain

- Brazil

- Canada

- Egypt

- England

- Germany

- India

- Ireland

- Israel

- Japan

- Jordan

- Kuwait

- Lebanon

- Nepal

- Republic of Korea

- Saudi Arabia

- Scotland

- United Arab Emirates

- United States (including District of Columbia, Guam, Puerto Rico & U.S. Virgin Islands)